Work Integrated Learning

Work Integrated Learning and Career-ready Placements

Work Integrated Learning (WIL) is an umbrella term that refers to a range of practical experiences designed to give students valuable exposure to work-related activities during and relevant to their study. These can include internships, placements, practicums, project-based activities, and both on-campus and off-campus experiences. Career-ready Placements (placement) is the University’s flagship WIL initiative that allows students to put theory into practice within organisational settings. Career-ready placements include authentic and genuine activities, which are credit-bearing and assessed and include internships, practicums, clinical and professional placements and industry-led projects.

University Insurance

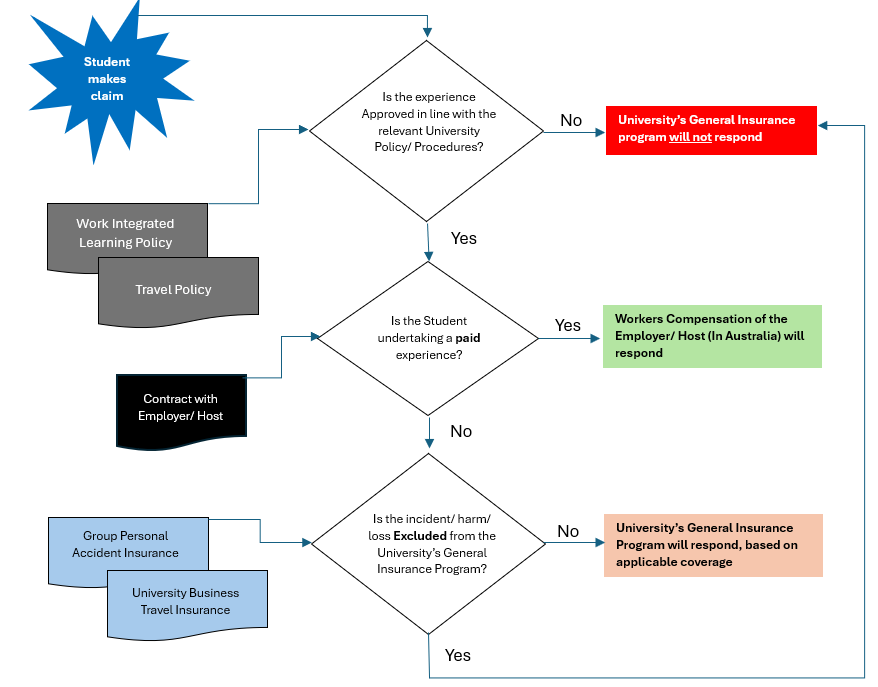

The University maintains several insurance protections which may apply to students undertaking work integrated learning experiences and are appropriate to student placements, including career-ready placement activities. These include General and Public Liability Protection, Professional Indemnity Protection, Medical Malpractice Insurance, Group Personal Accident Insurance, and Travel Insurance

The insurance cover will apply differently, based on the nature and location of the placement, the circumstances of a loss or harm and contractual terms. Cover may be available where a student is undertaking an approved placement subject to the conditions, limits, and exclusions of each insurance policy. Note, there is no University property insurance for loss or damage to any personal property (vehicles, equipment, clothing, etc.).

See the Work Integrated Learning and Career-ready Placement Insurance Summary for more information. This summary contains key information regarding cover, general limits, exclusions and claims.

In addition to the below Confirmations of Insurance, we can provide a copy of the University’s Certificate of Currency for a relevant insurance policy upon request.

Host organisation insurance

Students should be aware of the role that insurance can – and can’t – play in the event of an incident while they are under the control and supervision of their Provider.

For an organisation to become an approved placement host, they require the following current policies:

- Public Liability Insurance

- Professional Indemnity Insurance

- Personal Accident Insurance

- Medical Malpractice Insurance (where applicable)

Where placements are unpaid, students are not an employee of the Host Organisation and therefore no Workers’ Compensation applies.

If students are paid by the Host Organisation, they will enter an employment contract with the Host Organisation. This means they should be covered by the organisation's insurance policies, including Workers’ Compensation. Employment arrangements must also comply with the Fair Work Act 2009.

For more information please see the Work Integrated Learning and Career-ready Placement Insurance Summary which has key information regarding cover, general limits, exclusions and claims, or email for specific information, questions or concerns relating to Insurance.

To request a Certificate of Currency for career-ready placements, email the relevant Professional Experience Team Unit (PEU), Contact details:

| College | Contact |

|---|---|

| College of Engineering, Science and Environment | Website CESE-PEU@newcastle.edu.au (02) 4921 7302 |

| College of Health, Medicine and Wellbeing | Clinical placements webpage |

| College of Human and Social Futures | CHSFWIL@newcastle.edu.au (02) 4055 5504 |

The University of Newcastle acknowledges the traditional custodians of the lands within our footprint areas: Awabakal, Darkinjung, Biripai, Worimi, Wonnarua, and Eora Nations. We also pay respect to the wisdom of our Elders past and present.